Cobber Casino offers everything you'd expect from a quality mobile based casino platform including a great range of games from top providers. The casino is well made and runs on the Jumpman Gaming platform so you will feel right at home.

Cobber Casino offers you a host of bonuses as you keep playing the games at various levels. It is a good casino to register in if you are looking for a casino offering a wide selection of casino games.

Cobber Casino has the key factors and tempting offers in place to capture the interests of prospective online gamblers. The casino managed to bring together a list of providers with a unique view of promotions for its players on both mobile and desktop.

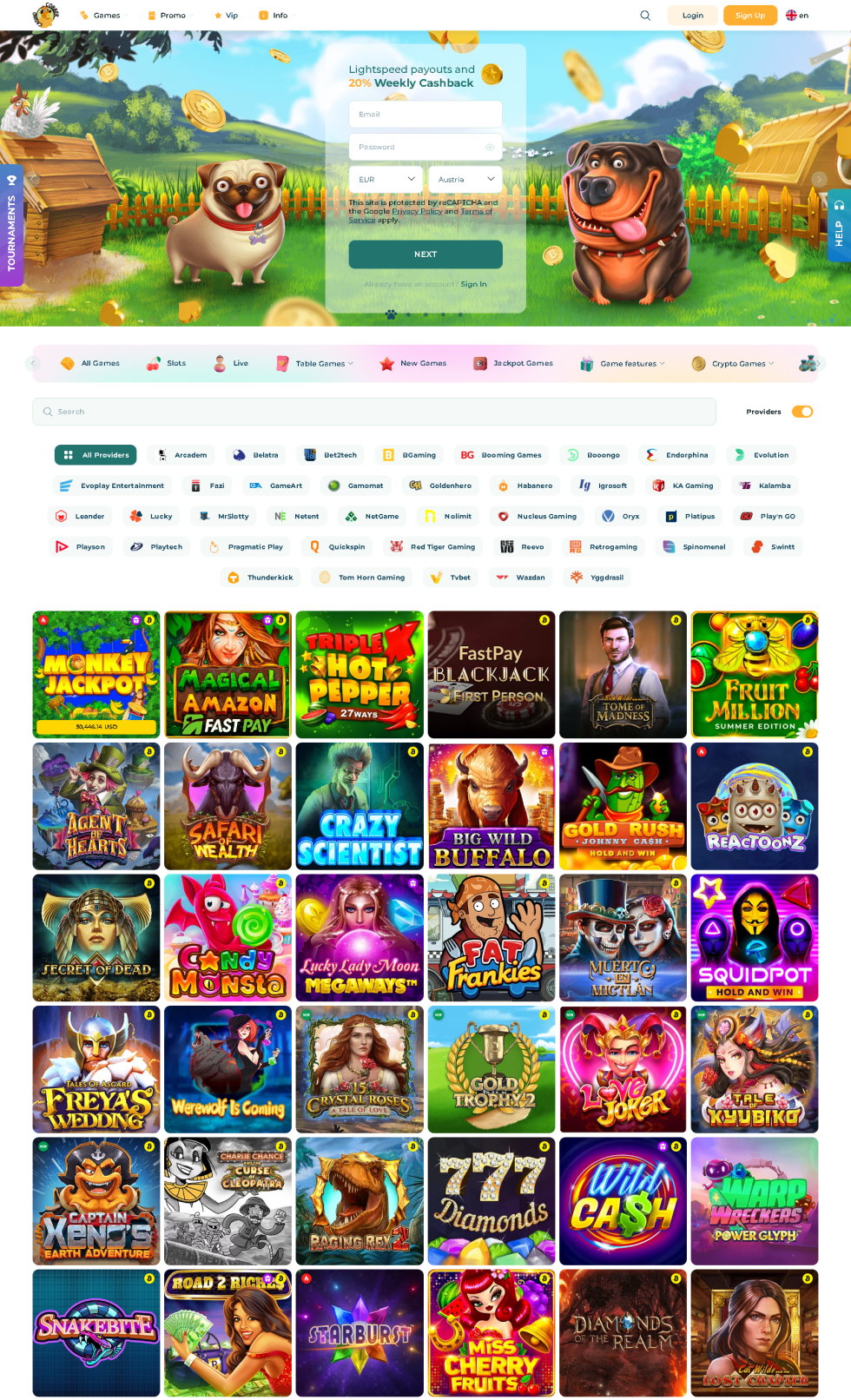

Cobber Casino has sourced games from a huge variety of game developers. These include NetEnt, Microgaming, NextGen Gaming, 1x2Gaming, iSoftbet, Leander Games, Quickspin, Pragmatic Play, Payson, Red Tiger Gaming, Core gaming, and the list goes on. You can be sure that the games will be of the highest quality, great graphics and a huge selection of themes, even including progressive jackpots.

All the games available at Cobber Casino can be accessed in instant-play mode with no download required. The casino is mobile-friendly and perfectly optimised for mobile play. You can enjoy on the go gaming from your Android or iPhone and tablets accessible from the casino.

Cobber Casino has a good selection of casino games totalling to over 600 titles, which gives players a wider pool to select the best games to enjoy at any given time. Some of the most popular slots here are Rainbow Riches, Fluffy Favorites, Starburst, Lucky Rooster and Book of Oz. If you're looking for a night at the tables, there are also several chances to take on the house at classic casino games such as blackjack or roulette.

Cobber Casino is operated by Jumpman Gaming and is licensed by the Curacao Gambling Commission.

Cobber Casino is 100% safe as they use the very latest in encryption technologies, which ensures you and your personal data remains safe at all times. The allcasino players safety is ensured by SSL encryption technology, keeping the sensitive data of the players fully encrypted and protected.

Cobber Casino uses the Secured Socket Layer (SSL) encryption technology verified by Comodo Limited, to protect sensitive data from being read by third parties and fraudsters. This protects hackers from gaining access to personal information.

Depositing money into your Cobber Casino account or withdrawing your winnings is extremely easy, thanks to the number of payment methods available. You can use the following deposit methods at this casino: Visa, MasterCard, Maestro, Paysafe cards, Pay by Mobile and Paypal.

Cobber Casino has a fairly basic customer support system. You can contact their team through email and live chat, but not by telephone. There's also a decent FAQ section if you want to find answers to questions without getting in touch with their customer service department.